Energy, Industry, and the 5% NATO Pledge

Europe—and especially Germany—enters the late-2020s with three interacting policy vectors: (1) a structural energy/competitiveness shock after the Russia pivot and EU’s REPowerEU decoupling; (2) a rapid, rules-driven defence build-up (toward NATO’s new 5% of GDP “defence and security” benchmark by 2035, of which 3.5% is core defence); and (3) tight fiscal frameworks (notably Germany’s Schuldenbremse and the 2023 court ruling) that constrain room to maneuver. The combined effect—if unmanaged—raises the risk of “crowding out” social spending, under-investment in energy transition/industry, and rising political stress. nato.intSIPRIEuropean CommissionReuters

Policy baseline: what has changed since 2022?

Energy & industry. The EU’s REPowerEU strategy hard-codes a rapid, lasting reduction of Russian fossil-fuel imports by end-2027, accelerating renewables, efficiency, and LNG diversification. This secured short-term supply but locked Europe into pricier import mixes and heavier infrastructure needs. EnergyEuropean Commission

Russia–China realignment. Moscow is deepening gas links with China—Power of Siberia flows and a new Power of Siberia 2 MoU (up to ~50 bcm/yr)—signaling a structural reorientation away from Europe and complicating any return to cheap pipeline gas. Financial TimesReuters

Defence policy shift. NATO leaders agreed in 2025 on a 5%-of-GDP benchmark by 2035: 3.5% for “core defence” (troops, kit) plus 1.5% for broader resilience/industry/cyber and infrastructure. All allies are expected to meet or exceed the old 2% goal in 2025—a historic change in baseline. nato.int+1Reuterspbs.org

Germany’s position. Berlin hit 2% in 2024 for the first time in decades, plans ~3.5% by 2029, and has set a 2025 defence budget of ~€62.4 bn plus special-fund outlays (NATO metric ≈ 2.4% of GDP in 2025). These steps come amid fiscal strain from the debt-brake and the 2023 Constitutional Court ruling that blew a hole in off-budget climate/industry financing. Reuters+3Reuters+3Reuters+3Bundesministerium der Finanzen

Budget math: what does 5% imply—and who pays?

Scale of the ramp-up. SIPRI estimates that if all NATO allies met the 5% guideline by 2035, annual spending would be roughly $4.2 trillion, up by almost $2.7 trillion vs 2024. Even getting to 3.5% (core) is a doubling or tripling for many Europeans. SIPRI

Germany’s path. Reuters’ mid-2025 budget coverage projects German defence outlays rising from €95 bn (2025) to €162 bn (2029)—about 3.5% of GDP—funded with nearly €400 bn in new borrowing over the plan horizon. Berlin’s official budget note puts €62.4 bn in the 2025 core defence line, with total NATO-defined defence ~2.4% of GDP once special funds are added. ReutersBundesministerium der Finanzen

Crowding-out pressure. Germany already devotes large shares to age-related items: pensions near 10% of GDP (projected +1.2 pp to 2070), and total health spending at ~13% of GDP. The IMF expects pensions +0.9 pp und health +0.7 pp of GDP by 2040—even before defence rises. With the debt brake capping structural deficits at 0.35% of GDP, higher defence outlays must come from taxes, re-prioritisation, or reform. dsv-europa.deOECDIMFReuters

EU-level signal. Draghi’s EU competitiveness report explicitly calls for a medium-term EU Defence Industrial Policy—more joint procurement and cross-border industrial integration—to avoid each state reinventing the wheel (and overspending). That matters if the 1.5% “resilience” slice is to yield spillovers rather than duplication. European Commission

Competitiveness fault-lines: energy costs, nuclear exit, and industry flight

Energy price gap. In 2023, EU industrial power prices were ~158% higher than in the U.S. German industrial users paid roughly $0.19/kWh in 2024 vs $0.08/kWh in the U.S.—a structural handicap for metals, chemicals, paper, and basic materials. ciphernews.comtrade.gov

Baseload & reliability. Germany’s final nuclear shutdown in April 2023 increased dependence on gas and weather-dependent renewables during a fast transition. Without faster grids, storage, capacity mechanisms and long-term power contracts, industry faces volatility premia. base.bund.de

Industrial retrenchment. Germany’s energy-intensive output has slumped from pre-crisis levels; 2024 data show continuing declines vs 2023. Flagship firms (e.g., BASF) have pushed multi-billion-euro European cost cuts and shifted investment abroad, citing high energy. This exemplifies the “erosion risk” for EU value chains if cost gaps persist. destatis.deargusmedia.comReuters

Why this matters for defence. A strong defence build-up needs a healthy industrial base (machine tools, chemicals, electronics). If energy disadvantages persist, the EU spends more for less—raising the odds that defence euros crowd out social budgets und still under-deliver capability. European Commission

Social budgets & political stability: the stress points

Demography vs. doctrine. Ageing alone raises Germany’s pension and health bill through the 2030s. Layer a rapid defence ramp on top—within a debt-brake regime—and fiscal arithmetic pushes hard toward either (i) tax hikes, (ii) social-spending restraint, or (iii) revising the rulebook. The 2023 court ruling narrowed off-budget workarounds, making re-prioritisation more explicit and politically costly. Reuters+1

If 3.5% by 2029, 5% by 2035. Berlin’s current plan to hit ~3.5% by 2029 already implies dozens of billions in annual new resources. Extending to 5% by 2035 without structural reform likely forces trade-offs that touch pensions, health, or transfers—and/or sustained higher taxes. (NATO-wide, only a handful meet 3.5% today; getting all to 5% magnifies the squeeze across the EU.) ReutersThe Washington Post

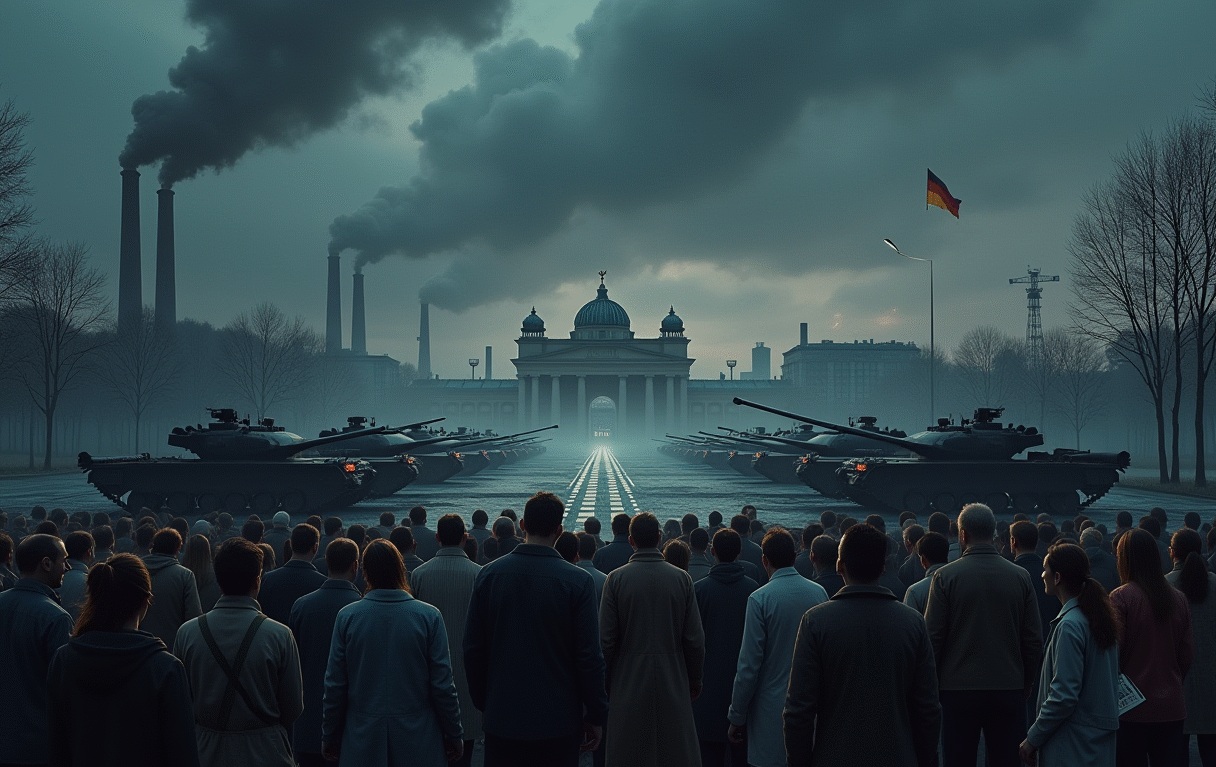

Political risk. History shows that conspicuous defence increases paired with visible social retrenchment are combustible. Europe has weathered mass protests over pensions and energy in recent years; a prolonged squeeze could deepen polarisation—even if governments try to shield the vulnerable. (NATO leaders themselves acknowledge resilience and civil preparedness as part of the 1.5% pillar—implicitly recognising this risk.) nato.int

Policy Implications & Options – An Eidoist Reading

A. The trap of following Trump’s pressure

The NATO pledge to raise defence spending toward 5% of GDP reflects not only Europe’s own anxiety, but also U.S. pressure — particularly under Trump’s transactional worldview. From an Eidoist lens, this is a dangerous mistake: Europe risks bankrupting itself in pursuit of symbolic recognition demanded by Washington rather than pursuing its own rational interests. To follow Trump’s demand blindly is to accept a role as subordinate rather than sovereign. True autonomy means choosing smarter options: investing in energy security, industrial renewal, and social cohesion, rather than diverting trillions into weapon systems that may never be used. Recognition earned by being an independent, resilient Europe is worth far more than recognition gained by simply obeying the loudest ally.

B. The smarter alternative: diplomacy and silent engagement

Eidoism insists that conflict is not inevitable. Russia, despite its aggression in Ukraine, has no rational motivation to invade Europe: such a move would bring no sustainable economic gain, only further isolation and destruction. What Russia seeks is recognition of its sphere of influence and dignity as a power. Instead of treating every Russian move as existential, Europe should pursue quiet, background diplomacy — channels of dialogue that explore compromises, energy cooperation, and confidence-building measures without public grandstanding. Public confrontation feeds the DfR spiral on both sides; private negotiation defuses it. Silent diplomacy does not mean appeasement, but a pragmatic recognition that dialogue is cheaper and more stabilizing than permanent militarization.

C. The DfR as driver of wasteful escalation

Die Demand for Recognition (DfR) explains why NATO’s 5% target is so appealing to leaders despite its economic nonsense: by spending more, governments feel they assert their dignity and seriousness. Yet this is an illusion. Armament races satisfy recognition temporarily, but they drain societies of real strength. In contrast, offering recognition through diplomacy — treating Russia as a counterpart rather than a pariah — interrupts the destructive cycle. Instead of escalating DfR by showcasing military hardware, Europe could redirect recognition-seeking into achievements in renewable energy, industrial innovation, and social stability.

D. The way forward

Europe must not allow itself to be trapped in Trump’s framing of “5% or you are weak.” Strength can take many forms, and for a continent like Europe, diplomatic strength may be its greatest advantage. By combining energy resilience, economic renewal, and discreet diplomacy with Russia, Europe can secure peace and recognition at a fraction of the cost of rearmament. The Eidoist view is clear: to follow militarized DfR is to walk into decline; to master recognition through diplomacy and constructive leadership is to find a sustainable future.-generating investment). NATO documents already separate these buckets—use that flexibility. nato.int

Bottom line

The EU’s post-2022 energy reset, Germany’s fiscal constraints, and NATO’s 5% by 2035 pledge form a policy triangle that can either reinforce European strength—or undermine it through crowding out and political backlash. The decisive variable is productivity-enhancing investment (energy, grids, defence industrial base) and integration (EU procurement, capital markets, labour). If Europe closes the energy-cost gap and spends smarter on defence (not just more), it can protect social compacts while re-arming. If not, the risk is precisely as you warned: social budgets under pressure, polarisation—and a weaker, not stronger, Europe.

Read more about: